Bank Marketing Strategies to Improve Financial Institutions

Digital marketing for accountants is guaranteed to make your accounting firm stand out from the many accounting firms in your area.

The financial marketing experts at Digital Logic are here to show you that bank marketing services aren’t just worth the time and money. Professional bank marketing strategies are essential for the success of almost every business in the banking industry.

Traditional marketing strategies are more expensive on a cost-per-lead basis. If you want to reach new customers, build brand awareness, and maximize the efficiency of targeted campaigns across digital channels, effective digital marketing campaigns can help you achieve those goals. In the following sections, we outline bank marketing and how it can benefit your financial institution.

Financial marketers need to create a brand that appeals to potential customers.

Bank marketing is the process of getting a brand in front of potential customers, increasing customer engagement, and acquiring leads through targeted campaigns and trends, recently through digital channels. Solid bank marketing strategies need to include digital elements. Otherwise, your financial institution can’t compete with the many banks that are taking advantage of digital marketing campaigns.

By including digital bank marketing solutions in the marketing budget, your targeted campaigns will deliver the following great opportunities:

Increasing brand awareness for new customers and existing customers

Generating additional behavioral data used to improve your digital marketing strategy further

Improving the customer experience by providing financial education resources

When SEO for the financial services industry is executed correctly, it outperforms all other channels that banks can use to grow.

Why Should Banks Rethink Their Marketing Strategy?

The benefits of marketing for accountants cannot be understated. A professional digital strategy for accounting firms can help with determining the target market, attracting new clients, speeding up the sales cycle or sales pipeline, and making the accounting firm (or even a future firm) appear as reliable as possible.

Consumer’s Buying Behavior Has Changed

Search engines and social media platforms have changed how consumers identify trends and how digital channels appeal to consumers. Financial marketers have the ability to reach more customers using technology, build a community around a brand, and gain more data surrounding the spending habits of consumers.

One of the latest changes in digital marketing trends is with respect to financial education for consumers.

Digital channels allow potential bank customers to receive some financial education from the comfort of their homes. For example, if consumers want to see the interest rates for a specific bank, they can do so using digital channels. Customers have more access to financial education resources than ever before.

This technology also allows financial marketers to send personalized offers to a longtime banking customer across a social media platform or email campaign.

These changes in customer engagement also reflect the way spending habits have changed for financial institutions as well.

It is no longer a necessity to spend exorbitant amounts on the traditional bank marketing budget. Instead, many banks have focused their efforts on appealing to digital bank marketing.

Recent advances in technology have underlined the need for future marketers and digital marketing services.

Modern, successful companies view bank marketing budgets as investments rather than expenses – as they should.

Technology is Different

Just as bank customers have changed, so have the trends and technology that is readily available. That includes technology used by both customers and marketers.

Digital marketing for the banking industry is a long-term investment that should increase your immediate ROI and continue to improve over time.

Digital marketing technology includes tools like artificial intelligence, marketing automation, and so much more.

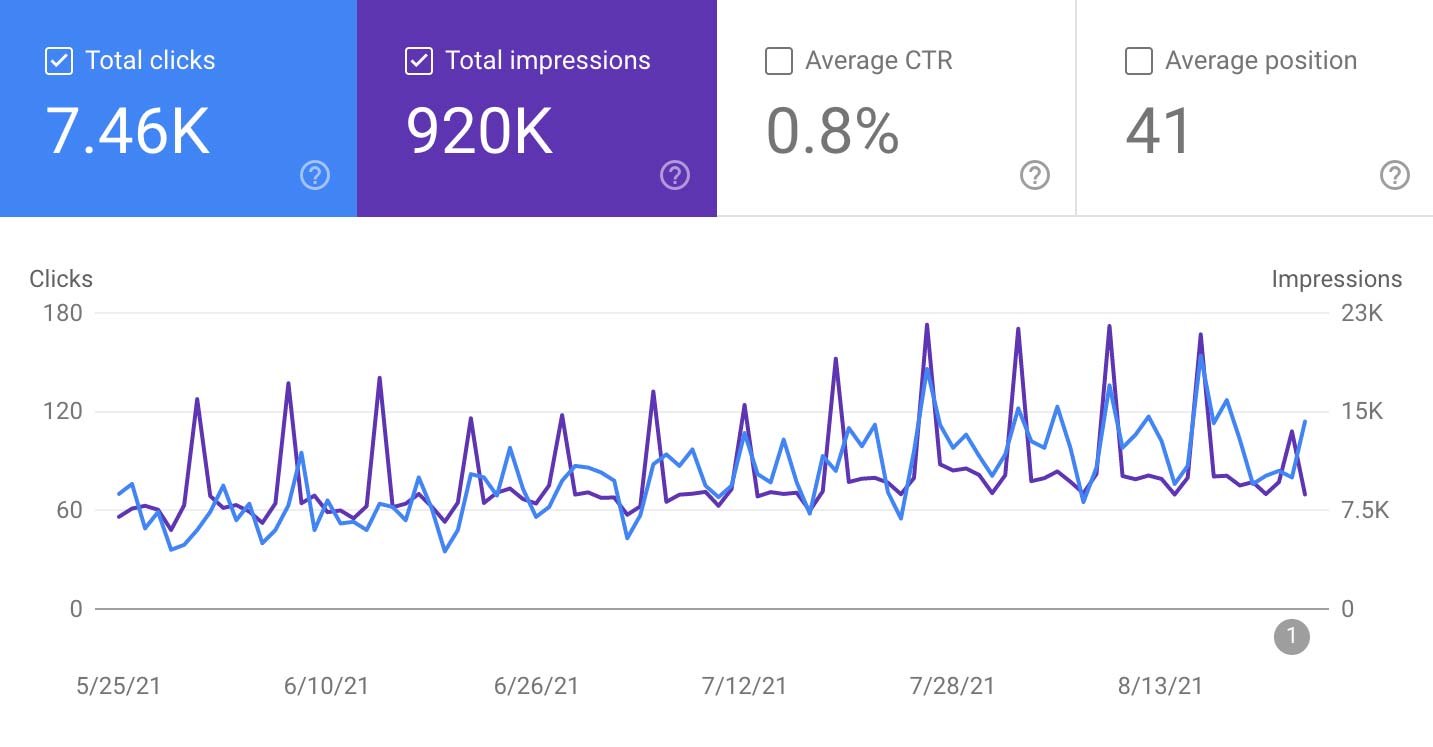

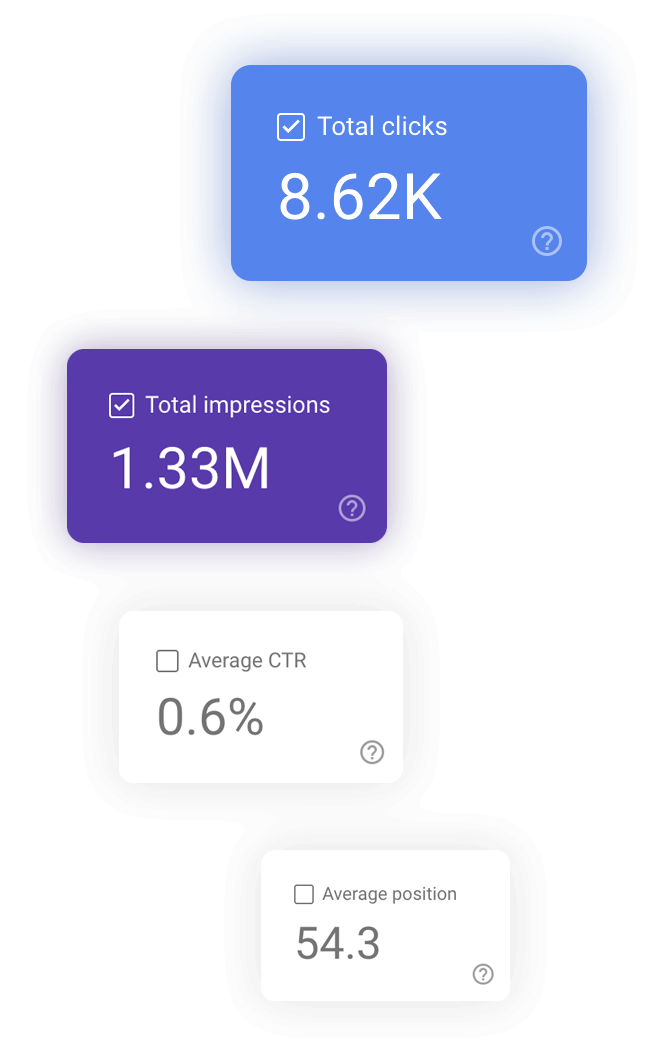

With advanced bank marketing tools at our disposal, we can now track the data of each marketing campaign with existing and potential customers alike. Then, we can use the data that we gather to further improve our growth, ads, or social media marketing ideas for banking services.

In other words, optimization is the key to getting the most out of your campaign spending.

Data Analytics Have Improved

Another key way that technology has improved is in the realm of data analytics. This especially helps with marketing for banks, marketing for financial services, or marketing for accountants!

Just by using the right tools, bank marketers can find all the trends and data they need about new or existing customers. Through analyzing different types of data, such as customer engagement, spending habits, and behavioral data, financial marketers develop tactics to streamline their strategies.

Optimizing a bank marketing campaign in this way helps to reduce wasted spending, increase customer generation, and ultimately generate more revenue for your brand.

As a credit union, bank, or other financial institution, it is crucial to shift your future focus to the digital realm. Otherwise, your financial marketing strategy may not have nearly as much success as it could.

Digital Marketing Services for Banks and Financial Institutions

If you want your bank, credit union, or other financial institution to stay ahead of the curve and avoid falling prey to obsolescence, you need a solid digital marketing strategy.

Not only will a professional bank marketing solution produce better results than traditional methods, but it will also make it easier to measure the true success of your strategies.

Banks and financial institutions stand to benefit from many different digital marketing strategies, including the following.

PPC Management for Banks

Pay-per-click advertising is a popular method of online advertising that only charges financial marketers when a customer clicks on the ad. PPC ads work by generating more website traffic. This generates an immediate ROI if the searcher converts into a customer.

These ads appear above organic search results when searchers seek banking services, giving your brand immediate exposure.

We offer PPC management services for financial institutions, which takes all the guesswork out of running ads on search engines.

By using data tools, our financial marketers analyze each PPC campaign to increase their efficiency.

SEO for Banks

Effective SEO strategies range from simple changes in content to highly complex technical processes. When a customer looks for financial services online, it is very unlikely that they will look past the first page of Google or any other search engine they might use.

Because of this, SEO is an essential part of any good digital marketing strategy. Although it does take time to see significant results, having a solid SEO strategy is what will set your brand up for future success.

Over time, the traffic that SEO will generate, as well as the ROI, will increase drastically. This is what makes SEO a cheaper investment the longer you take advantage of it. Speak with our top SEO agency to learn more about options for financial institutions.

SEO is the process of making adjustments to a website in order to improve its rankings in organic search results

Local SEO Services

If you’re looking to outsource SEO, local SEO offers great opportunities for banks or financial institutions. If your bank wants to attract more attention from local new customers, local SEO services are the way to go.

This technique has the same goal as regular SEO, which is to generate more site traffic. However, the specific way in which it is done aims to target a local audience.

Through local SEO, you can help your bank or institution become more visible to new customers and existing customers in your immediate area. This is an especially effective strategy for smaller local banks and businesses.

After all, a high level of traffic means nothing if that traffic isn’t coming from your target audience. We can use local SEO techniques and geofencing marketing techniques for a more inclusive strategy.

Website Development for Banks

The user experience, or UX, is the client-facing side of website design.

When potential customers find your website, your website should look professional, function well, and be easy to navigate. If a customer can’t find what they’re looking for quickly, they are likely to leave your site and continue their search elsewhere. This can really hinder one’s conversion rates, regardless of how much traffic their site gets.

This is where website development comes in. Our web development team is highly skilled in creating attractive sites that reflect your brand’s image, function exactly as they should, and are easy for customers to navigate. After all, your digital efforts may be for naught if a potential customer is immediately unimpressed with your site, for example.

Ready to partner with Digital Logic? Take a look at our web design and development services to learn more about how an impressive site can improve your ROI.

Why Choose Banking Marketing Campaigns From Digital Logic?

So, what makes Digital Logic stand out from other marketing companies? Our team is highly experienced in marketing financial services, including banks, credit unions, lenders, etc. Aside from our years of experience, we also bring other benefits to the table, including the following.

Data-Driven Digital Marketing Services

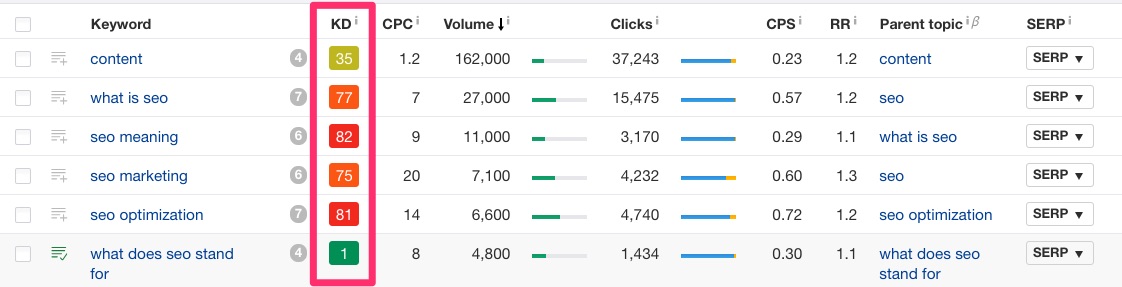

When we deliver creative solutions to our clients, it’s never a guessing game. We use real, measurable data to drive our marketing decisions from beginning to end. Through techniques like keyword research, we identify which avenues are worth pursuing and which avenues are unlikely to benefit you.

In other words, we tailor our approach to marketing your business specifically. The data never lies, which is exactly why we rely on it to drive our marketing and advertising decisions.

Transparent Billing Practices

Unfortunately, many so-called digital marketing companies try their best to charge as much as possible for as little as possible. They rely on their client’s lack of knowledge of digital marketing and pull the wool over their eyes when it comes to billing and showing results.

At Digital Logic, we prioritize maintaining consistent and open communication with our clients. We provide updates on a regular basis, ensure that any and all content intended for your site is approved before posting, and maintain transparent billing processes.

Every client that we work with is more like a partner. By working together and maintaining open communication, we can help you achieve better results than ever before.

High Client Retention Rates

When it comes to choosing financial marketers or ad agencies, it’s important to research whether or not their past or existing customers are happy with their campaign services.

Our agency has an exceptionally high retention rate of 97.3%, meaning most of those we work with stay with us.

Our clients’ successes are also our successes. This is what drives our dedication to delivering great results.

To better understand what our financial marketers have to offer, consider browsing our partner case studies. There, we outline the creative tactics we have used to help countless business owners find success in the online space.

Impressive Return on Investments

As anyone in the banking community knows, sales and growth are extremely important for a business. Spending money on a marketing campaign that doesn’t produce results, however, is bad for business. Our creative campaign tactics focus heavily on generating more leads, ultimately increasing your revenue and allowing you to stay ahead through those leads.

Both paid and organic methods have the potential for a high return on investment, so we make digital marketing our sole focus.

When you partner with our top digital marketing agency, you receive frequent updates on the ability and success of your campaign. This way, you have transparent data to show exactly how successful your marketing campaigns are.

Work With a Top-Rated Bank Marketing Agency

The bank marketing team at Digital Logic understands that most banks and other financial institutions have busy schedules.

That’s why we refuse to waste your time with one-size-fits-all plans. Instead, we provide personalized offers that target your individual needs as a business. During your initial free consultation with one of our digital marketing experts, we audit your site and help you understand how to improve your current strategy.

Our focus is on delivering the best results possible for your business so you can spend less time worrying about your marketing campaigns and more time running your business. To learn more about how we can help you achieve success in Internet marketing, give us a call. We would love to talk with you about improving your ROI, lead generation, and much more.